The financial industry is under pressure from both sides: customers expect increasingly personalized and instantaneous experiences, while businesses internally struggle with fragmented data, cumbersome processes, and inconsistent tools.

Not only traditional banks, but also financial, insurance, and fintech companies face the same question:How to understand customers better, serve them faster and convert them more?

I. What is Salesforce?

In the financial services industry, trust and long-term relationships with customers are the core foundations that create differentiated value.Therefore, applying customer relationship management (CRM) solutions is no longer an option, but a mandatory factor for modern financial institutions.

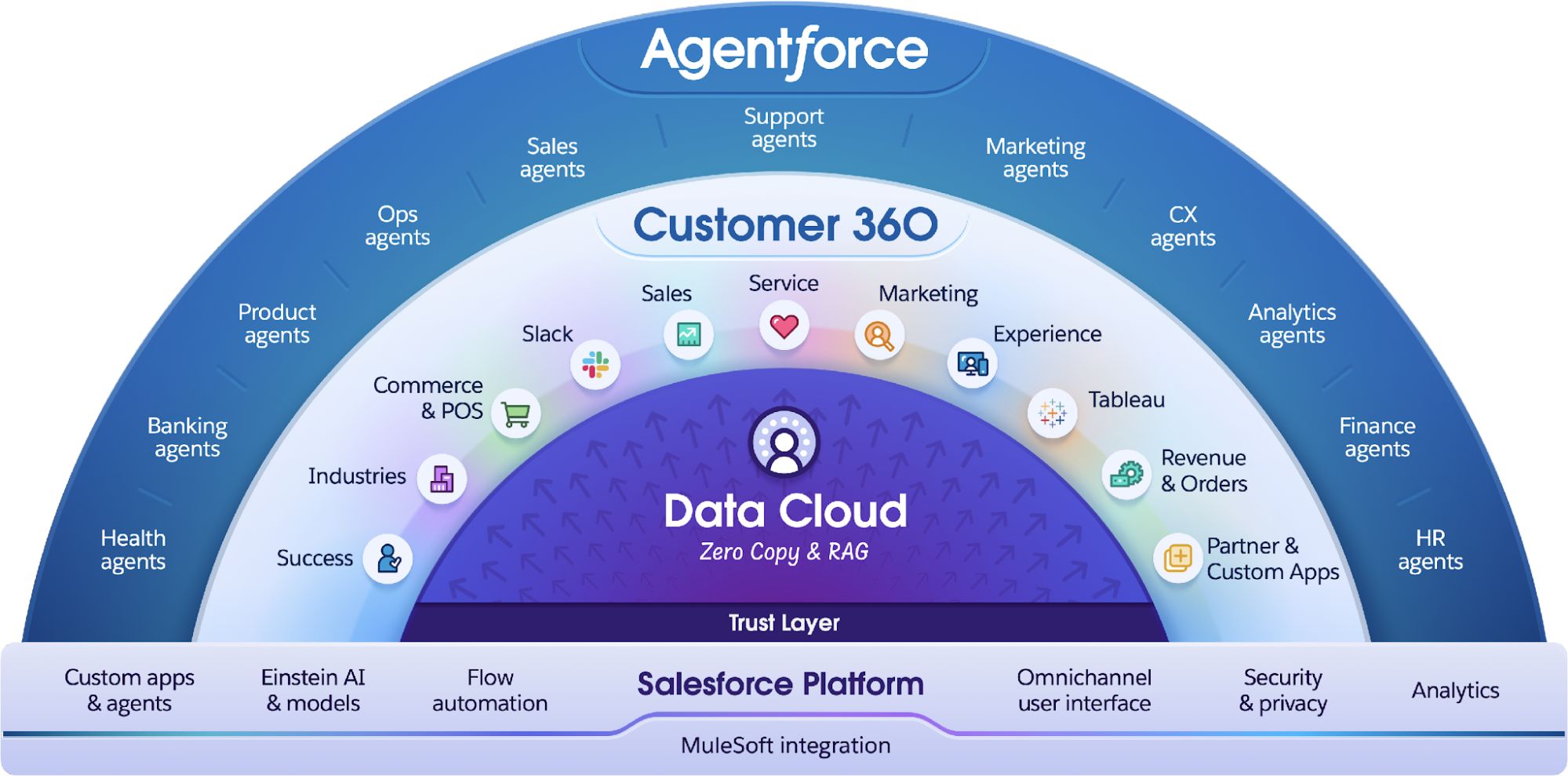

Salesforce Customer 360 solution – a comprehensive and flexible CRM platform – allows businesses to consolidate data, teams and all customer-related processes on the same ecosystem, including: sales, marketing, customer service, data analysis and automation. Thereby providing a comprehensive view of customers and enhancing personalized experiences at every touchpoint.

However, Salesforce implementation can be a significant challenge for many financial firms – especially when it comes to getting familiar with and operating the platform’s diverse and complex tools and features. This requires a clear implementation strategy, the right resources and, ideally, the support of an implementation partner with deep experience in the financial industry.

II. Why do financial businesses need Salesforce?

Salesforce – not simply a single software, this is a system that operates on a cloud platform, is easy to expand, integrate and especially has a version designed specifically for the financial industry:Financial Services Cloud, Providing solutions to meet all types of financial services businesses.

1. Banks: Enhance personalization & modernize customer experience

The modern banking industry is under constant pressure to innovate to meet the rising expectations of customers who expect fast, personalized, and seamless service across all channels. Salesforce helps banking organizations:

- Fragmented data connection: Customer data from multiple systems (core banking, transaction channels, digital channels, etc.) is consolidated on a single platform, providing a comprehensive and real-time view of the customer's financial journey.

- Increase consulting efficiency: Bank staff can make accurate and timely service recommendations (credit products, savings, investments, etc.) based on customer profiles, transaction history, and behavioral indicators.

- Optimize communication channel operationsSalesforce supports the implementation of the omnichannel model - from the transaction counter, call center to mobile application - helping customers experience a unified and consistent service at every touchpoint.

Salesforce supports all banking segments including mortgage and lending providers, retail, commercial, corporate banking. In particular, segments such as community banking, investment banking or corporate credit can also customize customer relationship management (CRM) processes to suit their business and organizational size.

2. Insurance: Automate business processes and increase flexibility in customer care

Insurance companies operate in a highly competitive environment where customer experience and speed of claims processing are key. Salesforce offers solutions that help the insurance industry:

- Business process automation: From quoting, contract issuance, claims management to after-sales care – every stage is fully optimized and digitized, minimizing processing time and manual errors.

- Increase the flexibility of your agent and broker team: The system helps agents quickly update customer information, contract status, new needs - thereby personalizing sales strategies and improving conversion rates.

- Improve after sales service: Customers can easily access contract information, submit claims or interact with support teams through multiple channels, increasing satisfaction and brand loyalty.

Salesforce serves the full spectrum of general insurance (P&C), life insurance and annuities, group insurance, and product distribution brokerage firms.

3. Personal finance and wealth management: Improve consulting efficiency and grow long-term customer value

The Wealth & Asset Management industry is rapidly shifting from a traditional advisory model to a data-driven, personalized model. Salesforce provides a platform that helps organizations in this space:

- Deep understanding of each customer's needs and goals:Through analysis of behavioral data, demographics and financial goals, financial advisors can build investment plans that are appropriate for each stage of a client's life.

- Proactively propose financial strategies and products:Thanks to constantly updated data, advisors can proactively advise on new investment opportunities, adjusting portfolios according to market fluctuations or risk periods – instead of just reacting when the client requests.

- Manage the performance of your advisor and your entire portfolio:Salesforce not only helps improve individual advisor performance, but also helps management track overall performance, analyze profitability, and measure customer satisfaction.

With Salesforce, asset management organizations not only increase assets under management (AUM), but also build sustainable, long-term relationships with individual clients.

Conclude

As customers demand increasingly personalized and instant experiences, while businesses face fragmented data and overlapping processes, Salesforce becomes the foundational solution that helps the financial industry thrive.

More than just a CRM, Salesforce is an ecosystem that unifies data, automates processes, and enhances experiences across every touchpoint. Whether it’s banking, insurance, or asset management, organizations can personalize services, increase efficiency, and build lasting customer relationships.

Investing in Salesforce is a strategic move for financial businesses to accelerate digital transformation and stay ahead of the game.

👉Contact OMN1 Solution now for full consultation and optimal Salesforce implementation for financial businesses!